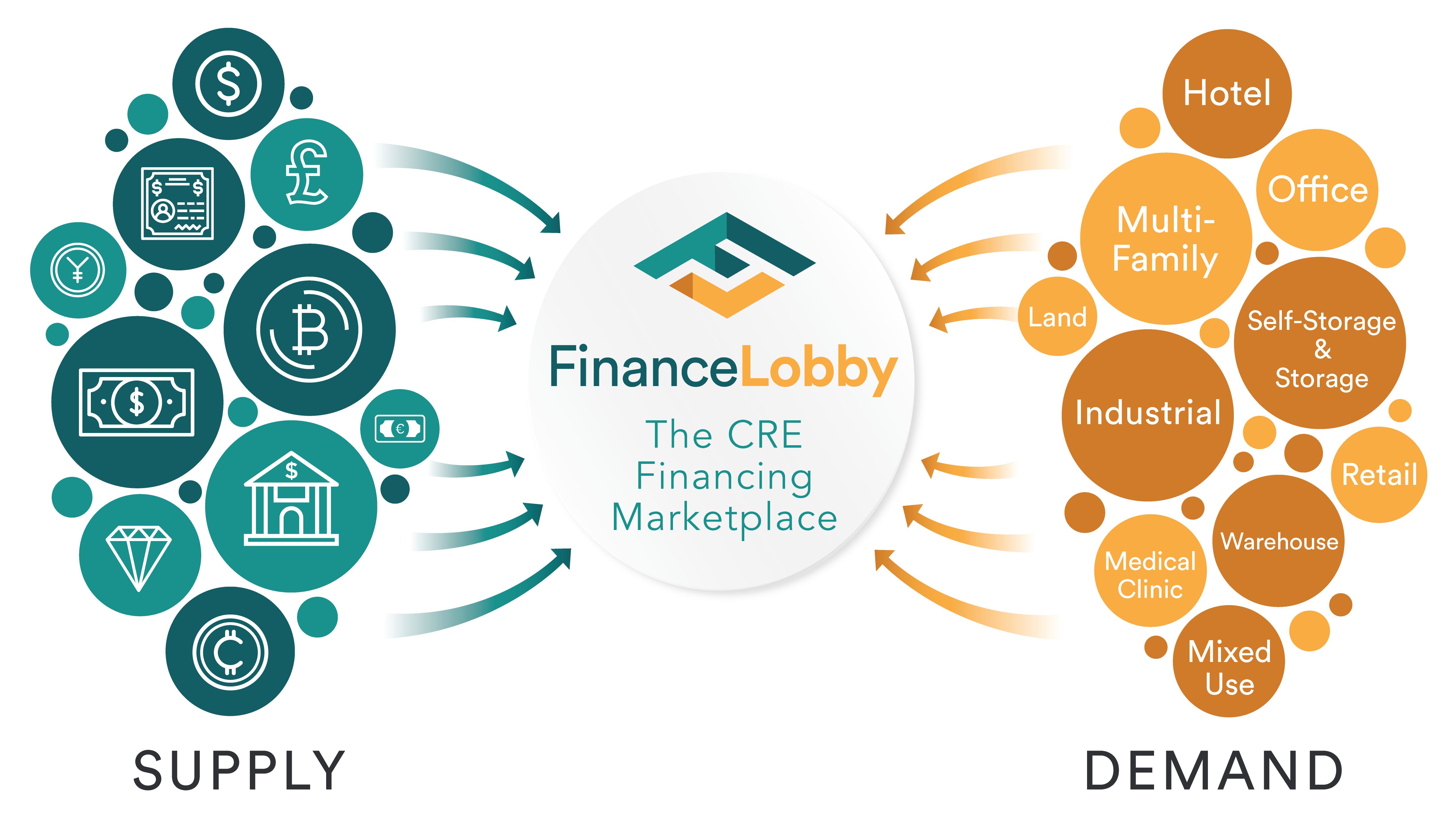

An online marketplace platform created by Finance Lobby is set to make commercial real estate (CRE) financing negotiations between brokers and lenders more efficient, vastly speeding up the process.

Gone are the days of countless phone calls and back-and-forth emails, and a financing process that can take months.

Finance Lobby's innovative concept launched in 2021 and enormous growth is expected this year, due to three main factors: the economy, user behavior and technology.

The economy

The new Infrastructure Investment and Jobs Act will begin finding major projects in 2022. The majority of funds will be allotted to the improvement of roads and electrical infrastructure, freight and passenger rail development, and the enhancement of public transit. By overall improving public infrastructure, enhancing electrical utilities, and making broadband networks more accessible and reliable, demand for CRE properties, such as warehouses and distribution centers along major trade routes, especially in rural areas, is likely to boom.

These properties will need to be financed and CRE brokers and lenders will be very busy, and Finance Lobby's online marketplace will make it a lot more efficient for both parties to find and facilitate the best deals.

User behavior

"Personalized user experiences" became one of the most dominant online trends in 2021 and this is set to continue and become an even more important factor in 2022.

When it comes to digital services, consumers want a seamless, personalized experience that won't fail, especially in crucial activities like making big purchases and finding accurate information in the most convenient way. Convenience in availing multiple services in one platform is also a top-of-mind user priority, making way for the sudden meteoric growth of online marketplace business models. Blending it with e-commerce, online marketplaces have become integral in various digital activities like online shopping and deliveries.

The Finance Lobby online marketplace method is beneficial to all parties in a CRE deal. Brokers can find the best financing deals, lenders can match deals to their guidelines and easily assess applications, and borrowers have a greater chance of getting their property investment loans approved.

Technology

With more industries pivoting to digital transformation and relying on technology, continual innovation will be needed to cope up with the demands of the digital world.

Finance Lobby's CRE marketplace paradigm is at the forefront of this tech revolution. Utilizing this next-gen business model for the CRE industry significantly decreases the ‘traditional' and tedious back-and-forths between brokers and lenders.

Finance Lobby finds the right deal and avoids mismatches. Brokers can propose finance deals with all the information lenders need to assess an application in just 90 seconds, while lenders can easily find and focus on the deals that are worth their time and effort.

Finance Lobby also provides a free, full-access account for lenders and brokers until they close their first deal.

Learn more at www.financelobby.com

Features

Baden Bower

https://www.badenbower.com/

news@badenbower.com