Allen Au clearly likes a challenge.

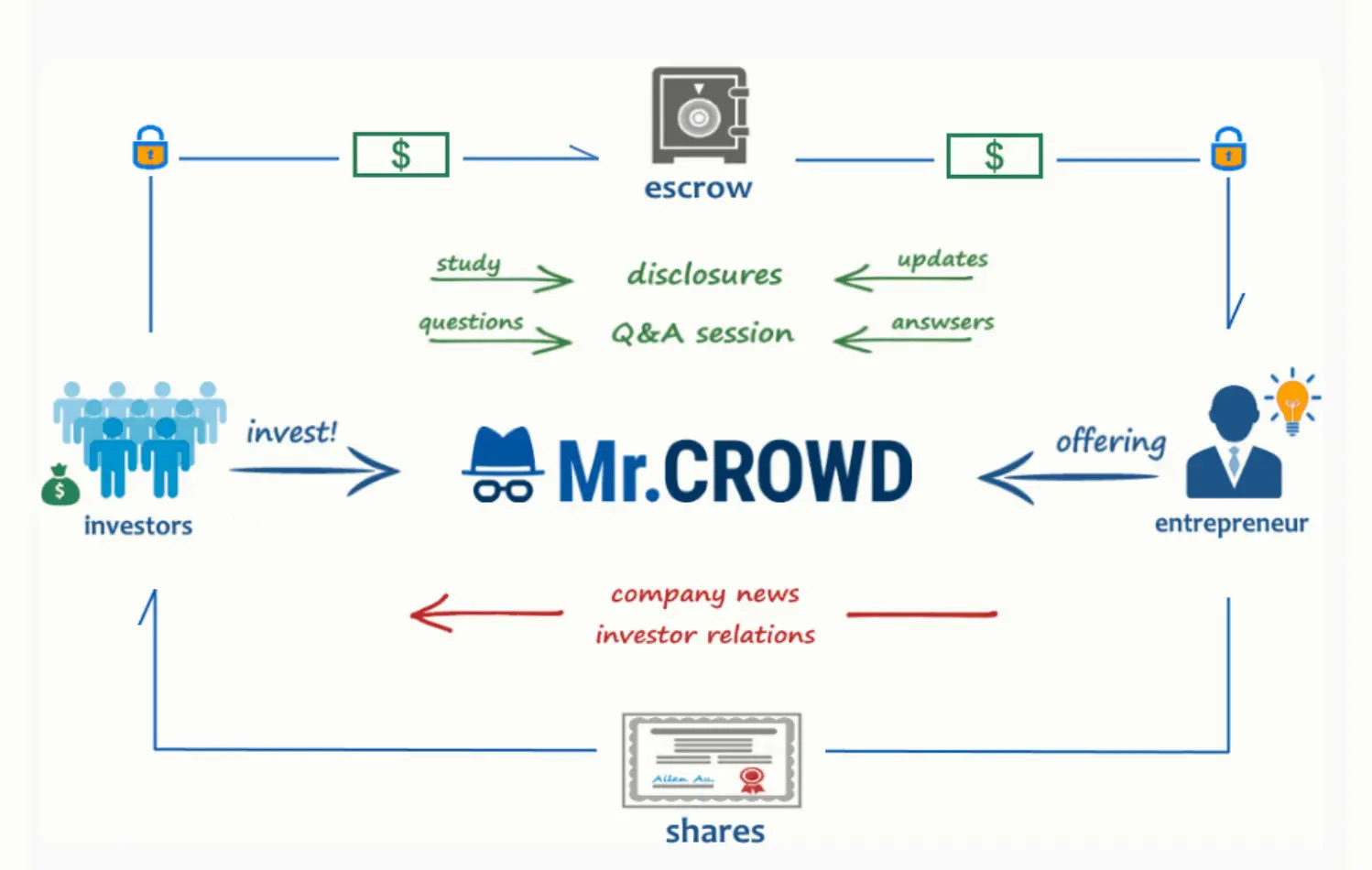

Amidst the crowdfunding cacophony, Mr Au established Mr. Crowd, a FinTech company that connects investors with startups and entrepreneurs.

What is regulation crowdfunding?

Driven by a need for more investment opportunities, regulation crowdfunding generates funding for startups and small to medium-sized enterprises (SMEs) that benefit both investors and entrepreneurs, via online equity crowdfunding.

Non-accredited investors can provide capital for - and take equity in - various startups and early-stage companies.

Allen Au and Mr. Crowd

Allen Au, Mr. Crowd's founder, chairman, and chief software architect, took the opportunity to establish the crowdfunding company after the implementation of Title III of the Jumpstart Our Business Startups (JOBS) Act in 2015.

The Act levelled the playing field for non-accredited investors, effectively allowing them to become shareholders in SMEs.

Mr. Crowd's long-term goal is to build an open financial ecosystem to facilitate smooth transactions between investors and entrepreneurs through blockchain, smart contracts, and machine learning frameworks. With more than 18 years experience in I.T. and the financial industry, Allen Au is putting Mr. Crowd at the forefront of one of the fastest-growing technological landscapes.

Au put in a lot of work researching and developing new technologies for the finance and investment sectors. His company aims to create value, enhance efficiency and reduce tedious and often unnecessary back-and-forth negotiations between investors and businesses.

Mr. Crowd then and now: what to expect in 2022

Mr. Crowd provides solutions for various stages of the business development process, from research and development to actual commercialization. Since its inception in 2020, Mr. Crowd has raised more than $200,000 in real estate investment returns, and Au believes that ROIs in various sectors, especially real estate, will continue to grow in 2022.

Committed to business excellence, Mr. Crowd complies with all the regulatory requirements governing equity crowdfunding set by the U.S. Securities and Exchange Commission (SEC). The company also guarantees that its processes are fair and orderly, that risks are managed effectively, and the paths of the funded businesses are consistent with the client's goals and the market's interest.

Features

Baden Bower

https://www.badenbower.com/

news@badenbower.com