How Do I Apply for the Coronavirus Small Business Loan?

To help SMEs operate during the COVID19 pandemic with loans from $5k – $300k, we have done the legwork. We looked online for the number of customer reviews left from real genuine customers, the aggregate score of the particular lender and looked at factors like transparency, customer service, application process and timeliness.

Why we love Prospa: They are Australia’s #1 online lender to small businesses, having the most number of reviews, highest levels of transparency, customer service with great marks for their application process and timeliness. They are assisting SMEs with a good credit score with fast funding to protect against decreasing revenues, cash flow issues, supplier payments and more.

Prospa versus The Rest

$5000 – $300,000 within 24 hours

- A lump sum between $5,000 and $300,000 over a term of 3 to 36 months

- Apply in 10 minutes with minimal paperwork required (business financials required for over $150,000)

- Fast decision with funding possible in 24 hours

- No asset security required upfront to access up to $100,000

Early repayment discounts available

- Set repayments (daily or weekly) to work with your business cash flow

- Early repayment discounts available

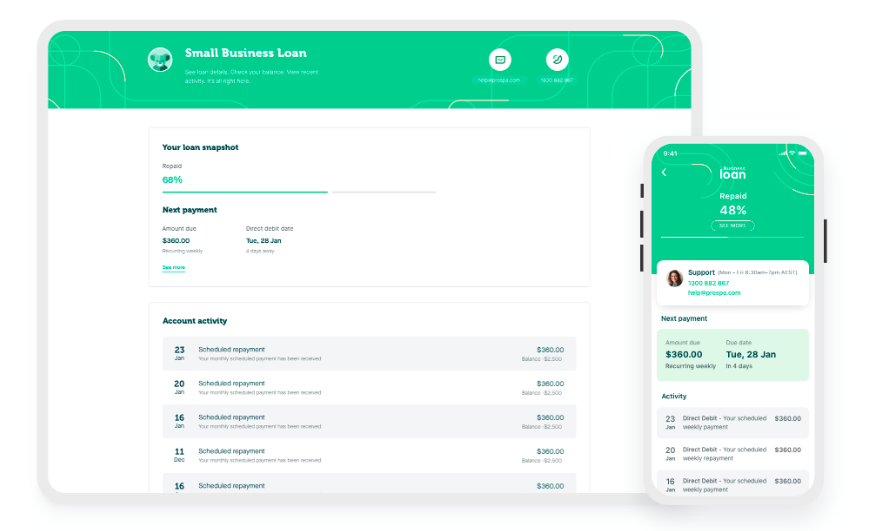

- Check balance wherever and whenever on the Prospa Mobile App and Customer Portal

Great customer support

- A team of Business Lending Specialists available however suits you – phone, email, chat

- Business resource hub to help you stay informed

- Competitive rates tailored to the health of your business

- Transparent fees: 3% origination fee

Moula provides loans to small and medium businesses through a unique platform that efficiently analyses data about a business loan applicant and determines the appropriate level of funding to provide. Moula is not a P2P lender, as it has its own Balance Sheet and does not rely on a platform to fund loans.

They provide quick capital from $10,000 to $200,000 to help small businesses across a range of industries.

OnDeck launched in 2007 to solve a major issue facing small businesses: efficient access to capital. Their passion for Main Street and the cutting-edge technology they use to evaluate businesses based on their actual performance, not solely business owners’ personal credit scores, make it possible for them to responsibly expand access to credit. This allows businesses to spend their time where it provides the most benefit—on their customers and on growing, not looking for a small business loan.

They understand that financing a small business can be a challenge that requires more time than most small business owners have in a day. Business operations, accounts receivable, accounting, and marketing are all an important part of running a small business—and financing shouldn’t slow down your focus on these issues; it should instead help a business grow. OnDeck offers financing options like short and longer-term loans and lines of credit, in order to grow your business.

Capify was born out of the desire to offer small businesses an alternative and accessible lending option. Proudly they were the first to do so in Australia. With 10+ years of local experience providing small business loans working capital globally, Capify is Australia’s most experienced alternative lender to small business.

With a focus on customer service and simplicity; our vision is to support Australian businesses with tailored financial solutions and solve small business finance. With our philosophy, they work together to create the most flexible and accessible commercial business loans for our clients. This allows them to streamline their internal processes passing on time and cost savings to you.

A fast decision on up to $300K

A Prospa Small Business Loan is a lump sum of between $5,000 and $300,000 with fixed repayments that work with business cash flow. The application process is easy and funding is possible in 24 hours.

- A lump sum between $5,000 and $300,000 over a term of 3 to 24 months

- Apply in 10 minutes with minimal paperwork required (business financials required for over $150,000)

- Fast decision with funding possible in 24 hours

- No asset security required upfront to access up to $100,000

- Set repayments (daily or weekly) to work with your business cash flow

- Early repayment discounts available

- Check balance wherever and whenever on the Prospa Mobile App and Customer Portal

- A team of Business Lending Specialists available however suits you – phone, email, chat

- Business resource hub to help you stay informed

- Competitive rates tailored to the health of your business

- Transparent fees: 3% origination fee

How It Works?

If your monthly turnover is more than $6,000 and you have over 6 months trading history, you’re ready to go.

You need an active ABN, business bank account details & driver licence details (plus business financials for loans over $150,000).

With funding possible in 24 hours and 24/7 access via the Prospa Mobile App and Customer Portal.

What could your business do with a cash lump sum?

- Purchase equipment or tools

- A renovation or fit out

- Upgrade equipment or machinery

- Marketing campaigns or promotions

- Build a website

- Buy office or café furniture

- Pay tax or BAS lump sums

Business Funding Options

They offer a range of finance solutions that provide fast access to funds and repayments tailored to your business cash flow. Their Small Business Lending Specialists will get to know your business and help you find the right finance solution for your needs to put you in control of your business now and in the future.

They offer a Business Line of Credit of $2,000 to $100,000 and Small Business Loans from $5,000 to $300,000 with no asset security required upfront to access up to $100,000. Whatever your business goals, they offer a range of finance solutions to help you achieve them – with a competitive interest rate.

Join the thousands of small businesses that have received business funds from Prospa. Simply submit your application online or call them on 1300 882 867. One of their friendly lending specialists will work with you to customise a proposal and answer your questions.

At Prospa, they specialise in Australian business lending with a fast and easy business loan application process, offering more flexible small business financing options that works with you to grow your business.

Once your application is approved, funding is possible in 24 hours. There is no cost to apply, no obligation to proceed and no hidden fees.

Whether it’s a business overdraft, equipment finance or cash flow support, they are passionate about helping small business owners access the money they need to maintain the momentum. Their founders were small business owners themselves and know the challenges of running a small business.

Prospa is trusted by Australian small businesses with over $1.35 billion lent to more than 24,000 Australian business owners so far. They are Australia’s #1 online lender to small businesses and #1 Best Non-Bank Finance company on Trustpilot.

They won Fintech lender of the Year at the MFAA Excellence Awards and topped the FT1000 High Growth Company list for the Asia Pacific region in 2018. Prospa is a proud signatory of AFIA’s Online Small Business Lenders Code of Lending Practice.

They have a network of over 10,000+ distribution partners who help them provide online business finance, including integration partners like Xero and Reckon; as well as brokers, accountants and franchisors around Australia.

There is no cost to apply for their business loans or line of credit, so why not find out whether you qualify now? Call 1300 882 867 or get started on your application today.

Awards

Common Questions

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $150,000 or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

For loans over $150,000, you’ll also need some basic financial statements, like a P&L and cash flow.

Typically, they can provide a response within an hour when applying during standard business hours and allow us to use the advanced bank verification system link which enables us to instantly verify your bank information online. If you choose to upload copies of your bank statements, we can provide a decision in as little as one business day.

If you apply before 4pm on a business day and your application is approved, it is possible to have money in your account as early as the next business day.

The total amount you can borrow will depend on the specific circumstances of your business. They consider a variety of factors to determine the health of your business and based on this information, Prospa may be able to provide you a loan amount of up to $300,000.

A Prospa Small Business Loan can be used for almost any business purpose – including for growth, to take advantage of an opportunity or to support cash flow. For example, it could be used for business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more. Funds from Prospa’s Small Business Loan cannot be used for personal purposes.

You can apply for the Prospa Small Business Loan in as little as 10 minutes online or over the phone. Depending on the time of day you apply, approvals can be achieved “same-day” with funds in your account within 24 hours. The Prospa Small Business Loan details the total amount payable upfront including any interest, fees or charges. This is then broken down into either a daily or weekly repayment figure.

Prospa offers Small Business Loans of $5,000 to $300,000 with terms between 3 and 24 months and cash flow friendly repayments that are either daily or weekly.

There are no hidden fees for their Small Business loans, and you’ll know exactly how much and when you need to pay from day one. There’s no compounding interest, no penalties for early repayment and no additional fees (as long as you make your repayments on time).

Our Conclusion

Prospa tops the list of small business loans providers. Unlike traditional lenders, Prospa understands small business owners need faster finance solutions – so you can make decisions quickly and seize opportunities with total confidence.

Fernando Camacho

Categories

- Accounting Software

- AirBnB Property Management

- Alimento Mascotas

- Art

- Awards

- BadenBower

- Beauty

- Blog

- Business Banking

- Business Coaching

- Business Services

- Car Tyre

- CEO Training & Education

- Community Services

- Courier Services

- Credit

- Credit Cards

- Cryptocurrency

- Cybersecurity

- Data Heatmap

- Data Privacy Management Software

- Dating

- Destacados

- Digital Marketing

- E-commerce Platform

- e-Signature

- Ecommerce

- eCommerce Analytics

- Education & Training

- Electrical Services

- Email Signature Software

- Energy

- Enterprise

- Entertainment

- Events Management

- Fashion

- Featured

- Finance

- Find a Tradie Websites

- Fintech

- Fitness

- Food

- Food & Restaurants

- Fragrance

- Furniture

- Gaming

- Graphic Design Software

- Groceries

- Hair Care

- Health

- Help Desk Software

- Hotels

- Insurance

- Interiors

- Inventory Management Software

- Inventory Management Systems

- Investment

- kids

- Landing Page Builder

- Legal

- Legaltech

- Logistics

- Logo Maker Software

- Marketing

- Marketing Automation Software

- Marketplace

- Mattresses

- Medical

- Money

- Motorsport

- Music

- Music Streaming

- Online Backup Software

- Online Business

- Online Literature

- Online Marketplaces

- Online Security

- Outsourcing

- Outsourcing Companies

- Payment Processing

- Payment Services

- Pest Control

- Pet Food

- Plumbing

- PR Agency

- Prescription Glasses

- Project Management Software

- Property Management

- Publicity

- Real Estate

- Real Estate Agent Comparison

- Recruitment Automation

- Rental

- SaaS

- Sales Analytics Software

- Service Industry

- Shipping Software

- Shopping

- Shopping Deals

- Software Translation Services

- Super Funds

- Survey Software

- Tech

- Time Sheeting Software

- Travel

- UX Design

- Watches

- Web Scraping

- Web Scraping Services

- Website Builder

- Wedding & Engagement

- Writing & Author