Let’s cover the most common questions people ask about the online tax return service at Etax.com.au

We hope these FAQ’s give you a clear understanding of Etax Accountants and the tax agent service we provide at Etax.com.au.

If you have a question that’s not covered below, please visit the contact us page or email us on admin@etax.com.au; we’ll be happy to respond. The Etax team is ready to answer your questions and we want you to be as informed as possible about your tax return.

When can I lodge my 2019 tax return?

“It’s ready to start now.”

You can start your 2019 tax return anytime at Etax.

Your 2019 tax return is for income that you earned between 1 July 2018 and 30 June 2019.

Why should I do my taxes at Etax?

- Fast & easy, no appointments

- Do it right now on your mobile or computer

- Service: Your accountant is ready to help out or answer your questions any time – online or by phone

- Maximise your refund: A qualified Etax accountant checks your return for extra deductions that can increase your tax refund, before it’s lodged to the ATO

- Confidence: Consumer surveys show the #1 reason people use a tax agent like Etax is, “Confidence my return is done right”. Your Etax accountant can correct mistakes, to prevent delays or ATO trouble.

- Help: At every stage, you have access to online help… with video, plus direct help from real accountants (in Australia) on live chat, phone or your secure “My Messages” inbox)

- Amazing tax website with live help and new features based on your suggestions

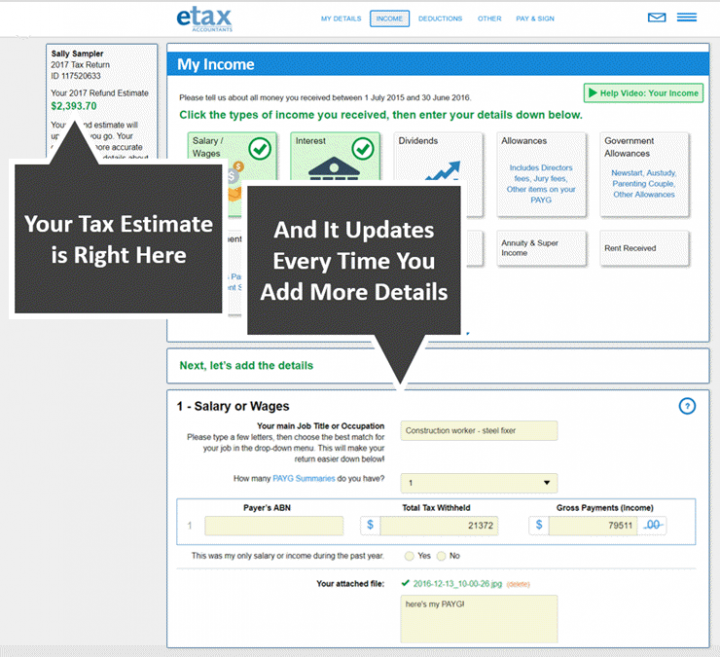

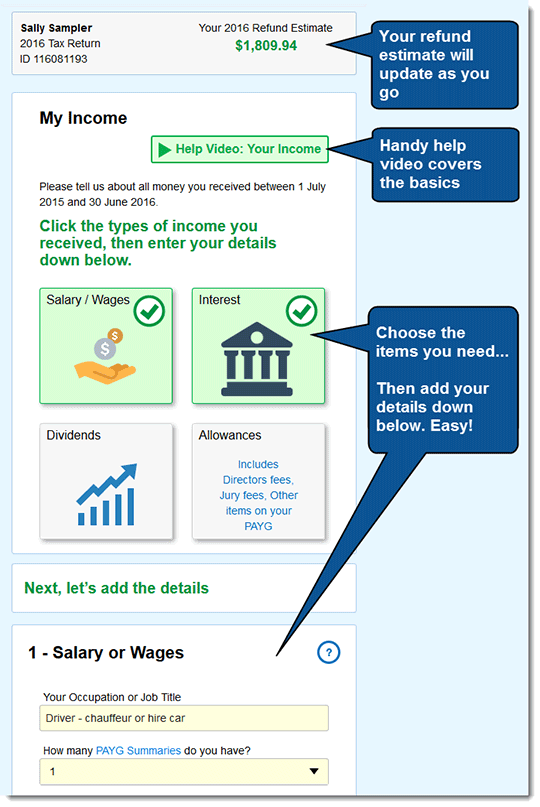

- More accurate refund estimate: Enter your details in the Etax online tax return to, including TFN, birthdate and occupation. Next, Etax will guide you through your income and deduction tips to help boost your tax refund

Etax has been Australia’s favourite online tax agent service since 1998. We are committed to high quality and superior service. As an added service for our clients, we offer free tax advice year-round to make your life even easier!

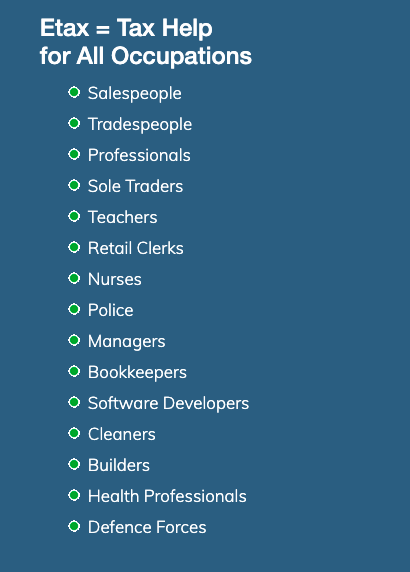

Our qualified accountants have decades of training between them and will help you get the refund you deserve and avoid ATO trouble.

What if I forgot my Etax password?

Click here to reset your password: Password & Login Help

If you prefer, you can also email admin@etax.com.au with any questions or ring us on 1300 693 829.

What are the opening hours of the Etax Service & Support centre?

Office Hours

Monday – Friday: 8:30 AM – 5:00 PM

Weekends: Closed

(All times are AEST – Etax is based in Brisbane, Queensland)

The Etax Service and Support Centre is staffed by qualified accountants. They are happy to answer your questions and help with your tax return.

You can access your tax return online, 24 hours, every day at www.etax.com.au!

What is the difference between Etax and the ATO’s myGov or myTax?

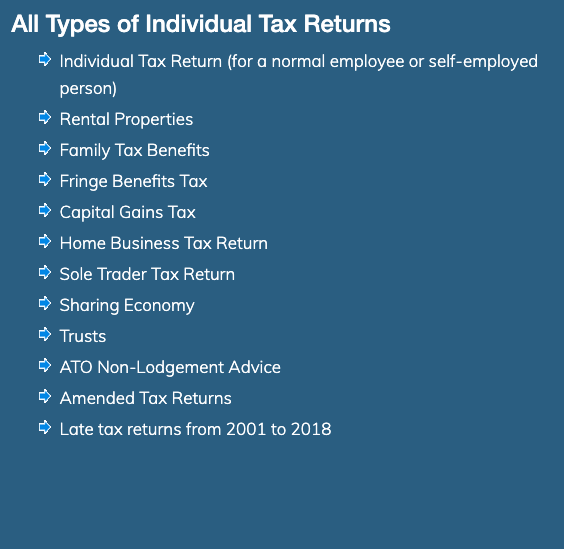

Etax is Australia’s favourite online tax return service – fast & easy, with expert tax agent advice. Etax was created in 1998 by Etax Accountants, a family-owned, registered tax agent and CPA-qualified accounting practice.

At Etax our goals are to maximise your tax refund, make tax easy and help you ensure you lodge accurate, trouble-free tax returns.

To put it more simply, at Etax we want to make tax returns awesome for Australians, with no worries and uncertainties.

Etax is upgraded and improved every year, along with the excellent service provided by the Etax Accountants Team.

Etax.com.au is a complete service giving you the latest technology in an easy online tax form plus live support and advice from real accountants.

On the other hand, the ATO’s myGov tax return and myTax system is a government system. Using ATO myTax, you are completely on your own to figure out what to enter and what to claim. On your own if you get an amended ATO assessment. On your own if you are audited or investigated by the ATO.

That’s why 74% of Australian tax returns are done with a tax agent like Etax – it’s just easier when you have an accountant on your side.

For more details and a full comparison visit this page about the differences between the ATO myGov tax return and Etax.com.au.

Do I have to pay when I lodge my tax return?

No! You can authorise us to take the very reasonable fees from your tax refund when it is issued by the ATO. To do this, you need to select “Fee from Refund” when you are on the payment method page. Please note, the final amount you receive will be less that our original estimate (after the fees are subtracted from your refund). The Fee From Refund service charge is just $27.50; please see below for details of tax return fees.

How much does a tax return cost at Etax? The low Etax fees are explained here

No fees up-front!

If you’ll receive a tax refund this year, no fee is required until the ATO issues your tax refund. (Choose the ‘Fee From Refund’ option).

Etax fees are also shown in a table at the signing (final) page of your tax return, together with your tax refund estimate.

Etax fees are tax deductible.

- Fast Etax Returns start from $69.90 ⇒ Australia’s favourite online tax return service, improved again for 2019 with better tax-saving features and support!

- We offer a low income service from only $38.50*

- Business Tax Returns start at $167.90

- Support is free. Some tax agents charge for help and phone calls, but not Etax

The optional $27.50 Fee From Refund service means you can lodge your tax return – with the help of a qualified accountant checking that your return is lodged correctly – and pay nothing at the time of lodgement. The Fee From Refund service is popular and convenient, and also it is very affordable compared to other tax agents that take a big fee or even a percentage of your actual refund (which we think is not fair).**

Etax has very low fees (or no fees) for items that most tax agents charge you for…

- Deductions (that help boost your tax refund)—no extra fees. In fact, our accountants will help you find extra deductions – also for free.

- ETP (Employee Termination Payment or redundancy payment)—no extra fees

- CGT (Capital Gains Tax)—no extra fees

- Investments and other income—no extra fees

- Rental Property Schedules—just $24.90 for the first one, and only $9.90 for additional ones

- Unusual, complex tax returns—FBT or CCR schedules are $24.90 each.

“Can my fee change?” If your return is adjusted after you sign and before lodgement, including the necessary addition of schedules or other information you provide, required details your accountant collects from the ATO, or tax agent review corrections that change the structure of your return, your fee may be adjusted accordingly. Fee adjustments usually only happens if business, ABN or other special income wasn’t mentioned by a taxpayer.

Overdue prior-year returns will have slightly higher fees of $95.90, because our reviewers and accountants need to refer to prior years’ ATO rules and ensure each return is compliant for the year of lodgement, plus we will negotiate with the ATO on your behalf if your late return has penalties or taxes owing. Your base fee is stated on the signing page of your return.

No additional fees are charged for tax agent support, live chat, advice, re-checking, accountant review and fast electronic lodgement of your return.

* Available to low-income Centrelink benefit recipients with no additional income sources and taxpayers under 18 years of age on 30 June of the tax return year (must select Adjustment item A1 in the tax return item selection).

** If the ATO amends or withholds your tax refund, the Fee From Refund service charge is not waived because we still incur additional costs administering and following up your return, using qualified staff. However, Etax will never charge a percentage of your tax refund.

What’s special about Etax?

Etax is the quickest, easiest way to lodge your tax return.

- NEW – Shows you last year’s deduction items, saving you time and helping avoid missed deductions (for returning Etax clients)

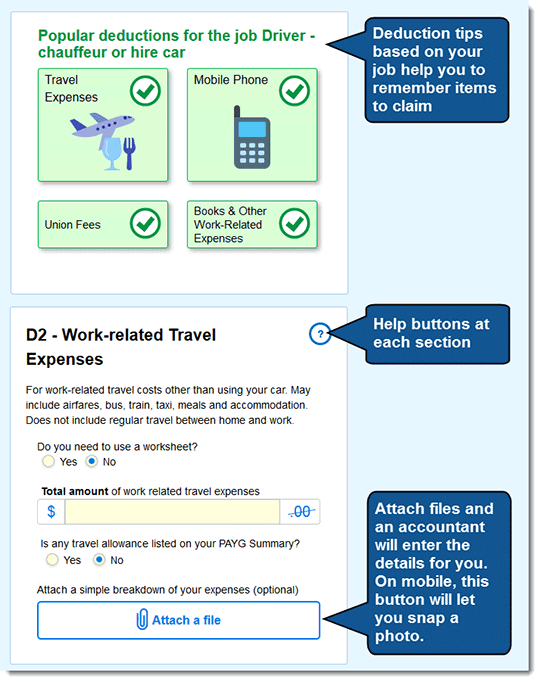

- NEW – Your Etax return shows popular tax deduction items used by people with the same sort of job as you, reminding you to claim deductions that can boost your refund!

- NEW – Etax can add ATO data directly into your return, saving you heaps of time (no need to go looking for papers, except for deduction receipts)

- NEW – More help content shown right in your return. Watch for blue links and question icons; click them for extra information

- Do it on mobile

- Friendly support from qualified accountants who are on your side

- The Etax mobile app for iOS and Android lets you snap receipts and documents and save them into your return, plus finish your return and check messages from your accountant, all on your mobile device. Learn more about the etax mobile app.