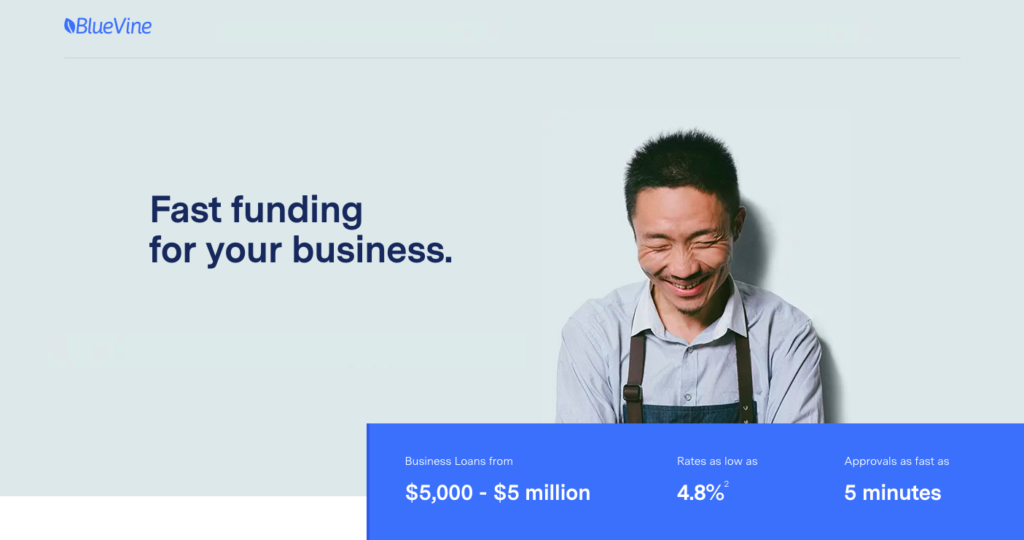

We reviewed the competition and found Blue Vine were the best lender to provide small businesses like access to capital when they need it. By combining the latest advancements in technology and security with the expertise and care of Blue Vine’s team, we found they able to serve business owners across the US in an efficient, simply, and honest manner. Just the way getting business financing should be.

Our confidence in BlueVine is constructed around the fact they service thousands of small business owners already, and help them every day with the funds they need to achieve their business goals. Simple & quick financing, snap!

The Competition

- Competitive Rates

- Approved Within Minutes

- 5 Star Customer Service

PRODUCTS;

- Line of Credit

- Invoice Factoring

- Term Loans

LoanBuilder is a subsidiary of PayPal that merged with Swift Capital and a few other alternative lenders to provide business owners with a unique alternative lending experience. Business owners can prequalify and then build their loan with their own terms and rates, depending on the financial stability of the business.

Lendio offers American Express Merchant Financing, SBA Loans, Term Business Loans, Short Term Loans, Business Lines of Credit, Startup Loans, Equipment Financing…see where I’m going with this? The list goes on and on.

Kabbage, Inc. is an online financial technology company based in Atlanta, Georgia. The company provides funding directly to small businesses and consumers through an automated lending platform.

Fundera is the go-to financial resource for every small business—helping you face your challenges, achieve your financial goals, and grow businesses as big as your aspirations.

Biz2Credit is an online credit resource offering finance to small businesses. The company provides direct funding to small businesses that have been in business for at least six months.

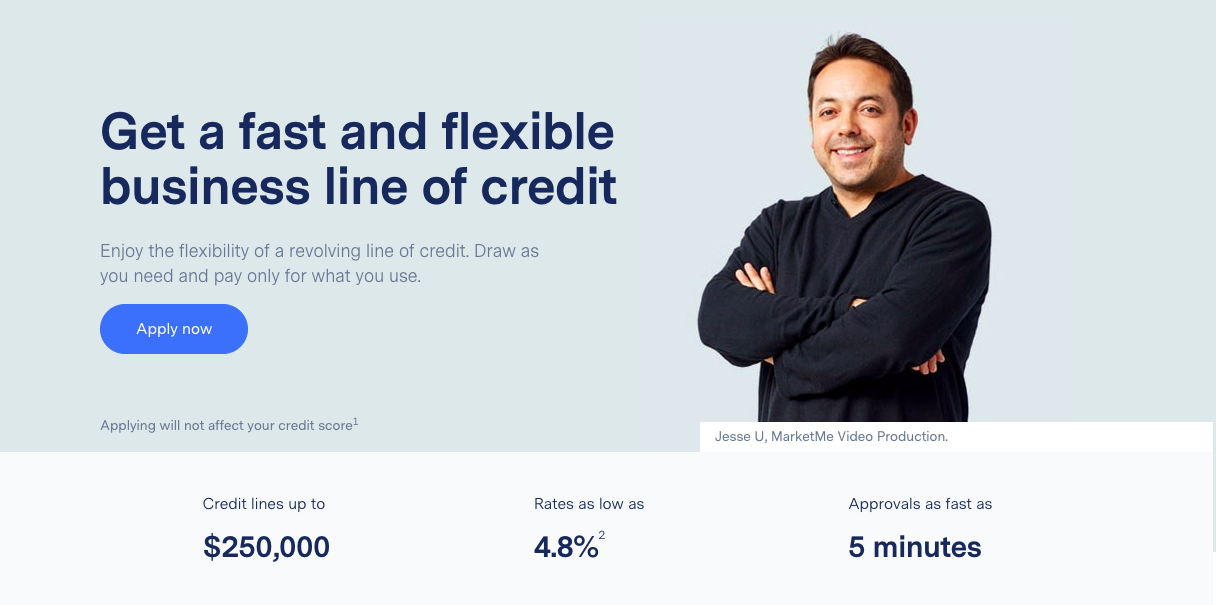

Enjoy peace of mind by having money available for any business expense. Draw funds with a click of a button.

No fees to open or maintain your line. No prepayment fees, monthly maintenance fees, or account closure fees.

Draw as little or as much as you want from your available credit. Your credit line replenishes as you make repayments.`

We support your business growth by getting you the right credit line for your business size at any stage.

Provide them basic information about your business and get approved in as fast as 5 minutes.

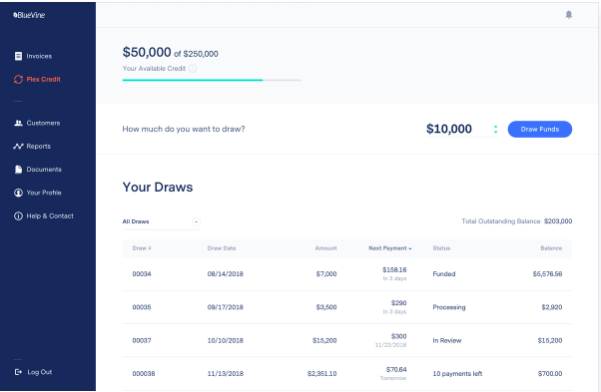

Use your online dashboard to request funds, and get cash in your bank account within hours.3

Pay back each draw with fixed monthly or weekly payments over 6 or 12 months.

As you pay off your balance, your available credit is automatically replenished.

Minimum qualifications

- 600+ FICO

- 6+ months in business

- $10,000 in monthly revenue

What you need to apply

- Basic details about you and your business

- Bank connection or 3 months most recent bank statements

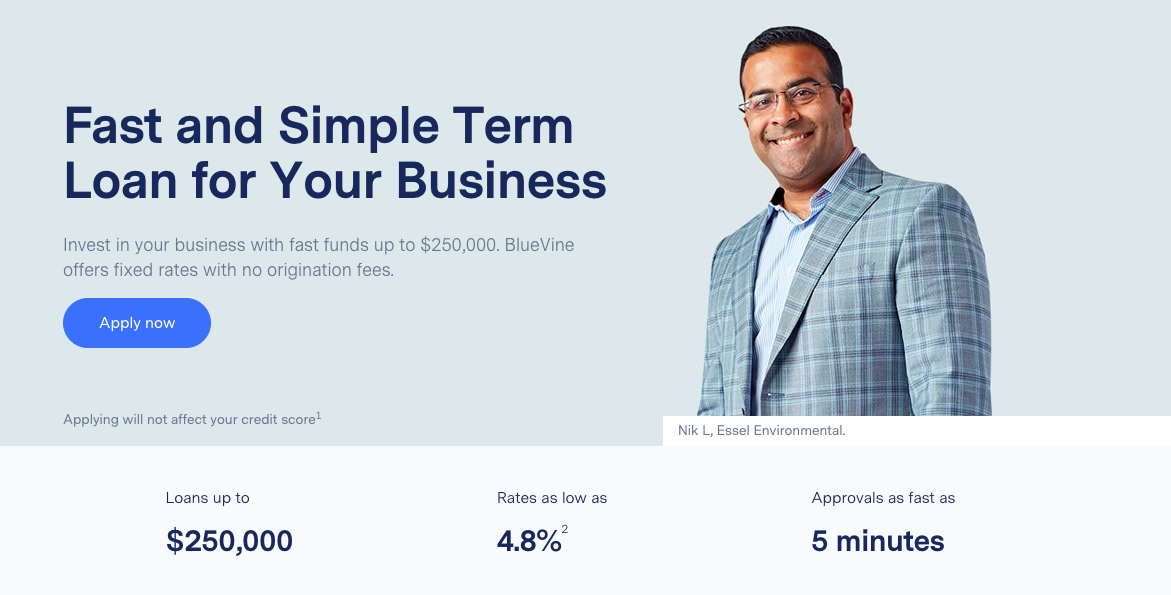

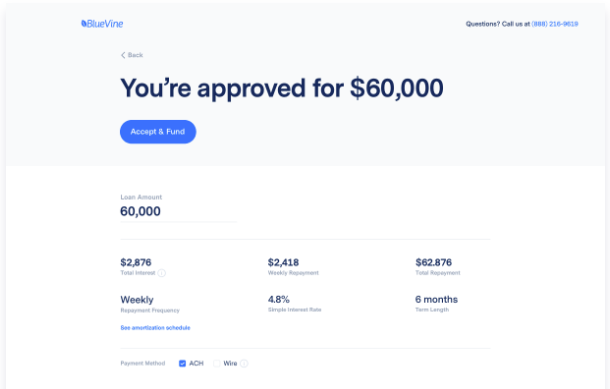

Get 100% of the funds upfront to invest in projects that help grow your business.

Their pricing is simple. Pay a fixed, weekly rate over 6 or 12 months, with no origination fee.

Apply online in minutes and have funds deposited in your bank account in as fast as a few hours.3

Their advisors are available to walk you through the process and help you obtain the funds you need.

Apply with basic information about you and your business. Your credit score won’t be impacted.

Get a decision on your application in as fast as 5 minutes.

Once approved, get cash in your bank account in as fast as a few hours.3

Payments are auto-debited from your bank account each week. No need to worry about missing payments.

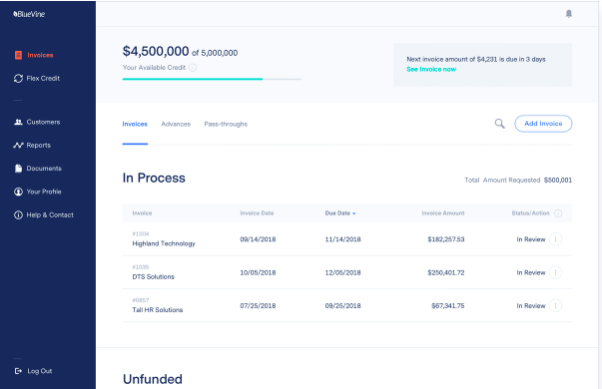

Get a credit line based on the strength of your customers. As your sales grow, so can your credit limit.

Unlike a traditional loan, there are no recurring payments when your customer pays by the invoice due date.

You decide how many and which invoices to submit. Fund only what you need, when you need, without long-term contracts.

Know exactly what you’re paying with our straightforward fees. We charge a simple weekly fee due when the invoice is paid.

Apply in less than 10 minutes with basic details about your business and customers.

BlueVine will review your application and reach out with a decision in as fast as 24 hours.

Automatically sync invoices from your accounting software or upload invoices to your dashboard.

They provide ~85-90% of the money upfront. You get the rest, minus our fee, once the invoice is paid.

Customer Reviews

BlueVine is the a leader in providing access to online working capital for small businesses. They offer generous invoice financing terms, allowing businesses to borrow up to $5 million through account receivable factoring.

About Review Rumble

From gyms to pet food, we research the market to find the most recommended and best companies in their sector.

Categories

- Accounting Software

- AirBnB Property Management

- Alimento Mascotas

- Art

- Awards

- BadenBower

- Beauty

- Blog

- Business Banking

- Business Coaching

- Business Services

- Car Tyre

- CEO Training & Education

- Community Services

- Courier Services

- Credit

- Credit Cards

- Cryptocurrency

- Cybersecurity

- Data Heatmap

- Data Privacy Management Software

- Dating

- Destacados

- Digital Marketing

- E-commerce Platform

- e-Signature

- Ecommerce

- eCommerce Analytics

- Education & Training

- Electrical Services

- Email Signature Software

- Energy

- Enterprise

- Entertainment

- Events Management

- Fashion

- Featured

- Finance

- Find a Tradie Websites

- Fintech

- Fitness

- Food

- Food & Restaurants

- Fragrance

- Furniture

- Gaming

- Graphic Design Software

- Groceries

- Hair Care

- Health

- Help Desk Software

- Hotels

- Insurance

- Interiors

- Inventory Management Software

- Inventory Management Systems

- Investment

- kids

- Landing Page Builder

- Legal

- Legaltech

- Logistics

- Logo Maker Software

- Marketing

- Marketing Automation Software

- Marketplace

- Mattresses

- Medical

- Money

- Motorsport

- Music

- Music Streaming

- Online Backup Software

- Online Business

- Online Literature

- Online Marketplaces

- Online Security

- Outsourcing

- Outsourcing Companies

- Payment Processing

- Payment Services

- Pest Control

- Pet Food

- Plumbing

- PR Agency

- Prescription Glasses

- Project Management Software

- Property Management

- Publicity

- Real Estate

- Real Estate Agent Comparison

- Recruitment Automation

- Rental

- SaaS

- Sales Analytics Software

- Service Industry

- Shipping Software

- Shopping

- Shopping Deals

- Software Translation Services

- Super Funds

- Survey Software

- Tech

- Time Sheeting Software

- Travel

- UX Design

- Watches

- Web Scraping

- Web Scraping Services

- Website Builder

- Wedding & Engagement

- Writing & Author