March 2021: Why You Should Apply With Prospa

New Zealand's small business lending specialist

Now with no repayments on business loans for the first 8 weeks

Don't Waste Time With The Rest, Go Straight To Prospa

February 2021 Review:

Best Small Business Loan Provider in NZ

Covid-19 has really put a strain on many small businesses in NZ. If you have been in business for more than 6 months and are looking for $5k – $300k, we have done the legwork.

Criteria For Selecting Our Top Small Business Loan Provider: We looked online for the number of customer reviews left from real genuine customers, the aggregate score of the particular lender and looked at factors like transparency, customer service, application process and timeliness. We also checked out their best deals, and found one EOFY promo in NZ of 8 weeks no repayments on your loan, offer ends 31 March 2021.

Why we love Prospa: They are the #1 online lender to small businesses, having the most number of reviews, highest levels of transparency, customer service with great marks for their application process and timeliness. They are assisting SMEs with fast funding to protect against decreasing revenues, cash flow issues, supplier payments and more.

Prospa versus Their Competitors

A Prospa Small Business Loan is a lump sum of between $5,000 and $300,000 with fixed repayments that work with business cash flow. The application process is easy and funding is possible in 24 hours.

- Need to be in business for at least 6 months prior to applying

- A lump sum between $5,000 and $300,000 over a term of 3 to 24 months

- Apply in 10 minutes with minimal paperwork required (business financials required for over $150,000)

- Fast decision with funding possible in 24 hours

- No asset security required upfront to access up to $100,000

$5000 – $300,000 within 24 hours

- A lump sum between $5,000 and $300,000 over a term of 3 to 36 months

- Apply in 10 minutes with minimal paperwork required (business financials required for over $150,000)

- Fast decision with funding possible in 24 hours

- No asset security required upfront to access up to $100,000

Early repayment discounts available

Other small business loan providers include KiwiBank, Zip Business, ANZ, Get Capital, Homesec and Harmoney.

How It Works

If your monthly turnover is more than $6,000 and you have over 6 months trading history, you’re ready to go.

You need to own a New Zealand business with a valid NZBN/IRD), have a business bank account details & driver licence details (plus business financials for loans over $150,000).

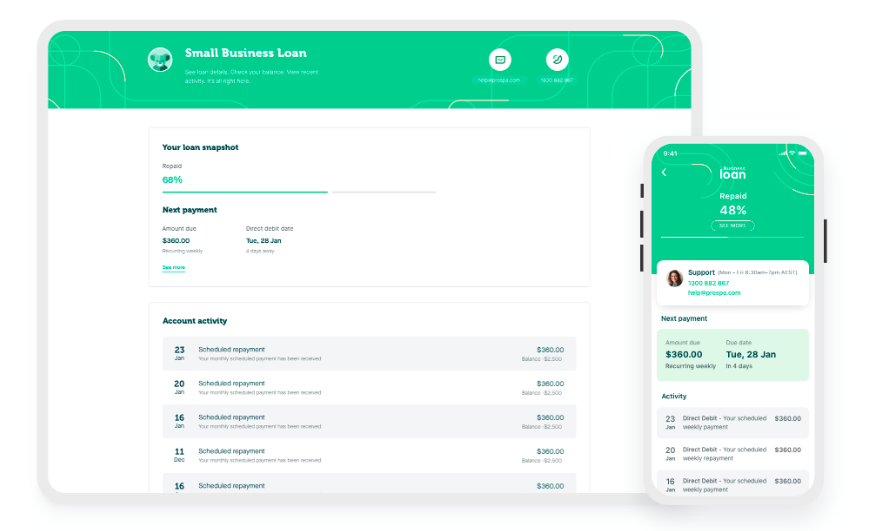

With funding possible in 24 hours and 24/7 access via the Prospa Mobile App and Customer Portal.

What could your business do with a cash lump sum?

- Purchase equipment or tools

- A renovation or fit out

- Upgrade equipment or machinery

- Marketing campaigns or promotions

- Build a website

- Buy office or café furniture

- Pay tax or BAS lump sums

Our Conclusion

Prospa tops the list of small business loans providers. Unlike traditional lenders, Prospa understands small business owners need faster finance solutions – so you can make decisions quickly and seize opportunities with total confidence.